Marshall-Miller & Company is considering the purchase of a new machine for $50,000, installed. The machine has a tax life of 5 years

Marshall-Miller & Company is considering the purchase of a new machine for $50,000, installed. The machine has a tax life of 5 years

PROBLEM SET THREE

Please answer all the questions as completely as possible.

Each question is worth 10 points.

Please download the problem set and upload your completed problem set as a word or pdf document.

The problem set is due no later than midnight of 03/19/2023.

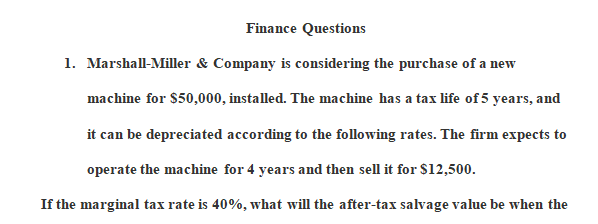

- Marshall-Miller & Company is considering the purchase of a new machine for $50,000, installed. The machine has a tax life of 5 years, and it can be depreciated according to the following rates. The firm expects to operate the machine for 4 years and then sell it for $12,500.

If the marginal tax rate is 40%, what will the after-tax salvage value be when the machine is sold at the end of Year 4?

Year Depreciation Rate

1 0.20

2 0.32

3 0.19

4 0.12

5 0.11

6 0.06

2. Sub-Prime Loan Company is thinking of opening a new office, and the key data are shown below. The company owns the building that would be used, and it could sell it for $100,000 after taxes if it decides not to open the new office. The equipment for the project would be depreciated by the straight-line method over the project’s 3-year life, after which it would be worth nothing and thus it would have a zero-salvage value. No new working capital would be required, and revenues and other operating costs would be constant over the project’s 3-year life.

What is the project’s NPV? (Hint: Cash flows are constant in Years 1-3.)

WACC 10.0%

Opportunity cost $100,000

Net equipment cost (depreciable basis) $65,000

Straight-line deprec. rate for equipment 33.333%

Sales revenues, each year $123,000

Operating costs (excl. deprec.), each year $25,000

Tax rate 35%

3. Thomson Media is considering some new equipment whose data are shown below. The equipment has a 3-year tax life and would be fully depreciated by the straight-line method over 3 years, but it would have a positive pre-tax salvage value at the end of Year 3 when the project would be closed down. Also, some new working capital would be required, but it would be recovered at the end of the project’s life. Revenues and other operating costs are expected to be constant over the project’s 3-year life.

What is the project’s NPV?

WACC 10.0%

Net investment in fixed assets (depreciable basis) $70,000

Required new working capital $10,000

Straight-line deprec. rate 33.333%

Sales revenues, each year $75,000

Operating costs (excl. deprec.), each year $30,000

Expected pretax salvage value $5,000

Tax rate 35.0%

4. TexMex Food Company is considering a new salsa whose data are shown below. The equipment to be used would be depreciated by the straight-line method over its 3-year life and would have a zero salvage value, and no new working capital would be required. Revenues and other operating costs are expected to be constant over the project’s 3-year life. However, this project would compete with other TexMex products and would reduce their pre-tax annual cash flows.

What is the project’s NPV? (Hint: Cash flows are constant in Years 1-3.)

WACC 10.0%

Pre-tax Cash Flow Reduction for Other Products (cannibalization) $5,000

Investment Cost (depreciable basis) $80,000

Straight-line Depreciation Rate 33.333%

Depreciation Per Year $26,667

Sales Revenues Per Year $67,500

Annual Operating Costs Excluding Depreciation $25,000

Tax rate 35.0%

5. Union America Corporation (UAC) is planning to bid on a project to supply 150,000 cartons of machine screws per year for 5 years to the US Navy. In order to produce the machine screws UAC would have to buy some new equipment. The new equipment would cost $780,000 to purchase and install. This equipment would be depreciated straight line to zero over the five years of the contract. However, UAC thinks it could sell the equipment for $50,000 at the end of year 5. Fixed production costs will be $240,000 per year, and variable costs of production are $8.50 per carton. UAC would also need an initial investment in Net Working Capital of $75,000 at the beginning of this project. UAC has a cost of capital of 16% and a tax rate of 35%.

What should be the bid price per carton on this project?.

6. The executives of GW Inc. are considering a project that has an upfront cost of $3 million. This project is expected to produce a cash flow of $500,000 at the end of each of the next 5 years.

The cost of capital is 10%

If GW goes ahead with the project today, it will obtain knowledge that will give rise to additional opportunities 5 years from today.

The company can decide at t=5 whether or not it wants to pursue these additional opportunities.

Based on the best information available today, there is a 35% probability that the outlook will be favorable, in which case the future investment opportunity will have a net present value of $6 million at t=5.

There is a 65% probability that the outlook will be unfavorable, in which case the future investment opportunity will have a net present value of -$6 million.

GW does not have to decide today whether it wants to pursue the additional opportunity.

Instead, it can wait to see what the outlook is. However, the company cannot pursue the future opportunity unless it makes the $3 million investment today at t=0.

What is the estimated net Present value of the project, after consideration of the potential future opportunity?

Requirements: none

Masters Finance

Answer preview for the paper on ‘Marshall-Miller & Company is considering the purchase of a new machine for $50,000, installed. The machine has a tax life of 5 years’

APA 1499 words

Click the purchase button below to download full answer…….