Leslie Printing has net income of $26,310 for the year. At the beginning of the year, the firm had common stock of $55,000,

Leslie Printing has net income of $26,310 for the year. At the beginning of the year, the firm had common stock of $55,000,

PROBLEM SET ONE

Please answer all the questions as completely as possible.

Each question is worth 10 points.

Please download the problem set and upload your completed problem set as a word or pdf documents.

The problem set is due no later than midnight of 03/05/2023

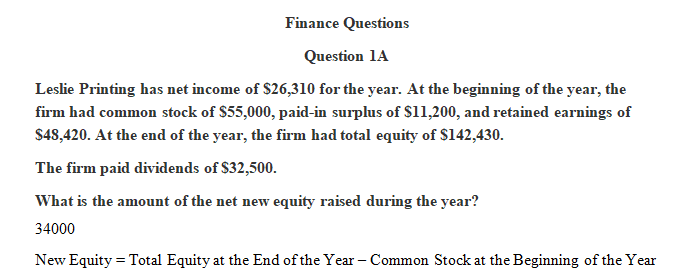

1A. Leslie Printing has net income of $26,310 for the year. At the beginning of the year, the firm had common stock of $55,000,

paid-in surplus of $11,200, and retained earnings of $48,420. At the end of the year, the firm had total equity of $142,430.

The firm paid dividends of $32,500.

What is the amount of the net new equity raised during the year?

1B. Western Hardwoods has total equity of $318,456, a profit margin of 3.79 percent, an equity multiplier of 1.68,

and a total asset turnover of .97.

What is the amount of the firm’s sales?

2A. A firm has net income of $197,400, a return on assets of 8.4 percent, and a debt-equity ratio of .72.

What is the return on equity?

2B. Tessler Farms has a return on equity of 11.28 percent, a debt-equity ratio of 1.03, and a total asset turnover of .87.

What is the return on assets?

3. You are negotiating to make a 7-year loan of $25,000 to Breck Inc. To repay you, Breck will pay $2,500 at the end of Year-1, $5,000 at the end of Year-2, and $7,500 at the end of Year-3, plus a fixed but currently unspecified cash flow, X, at

the end of each year from Year-4 through Year-7. Breck is essentially riskless, so you are confident the payments will be made.

You regard 8% as an appropriate rate of return on a low risk but illiquid 7-year loan.

What cash flow must the investment provide at the end of each of the final 4 years, that is, what is X?

4. Ten years ago Jim took a mortgage loan of $200,000 to be repaid in 20 equal annual installments of $30,197.34.

The bank has told him that they would accept $145,000 today as payment in full for the remainder of the loan.

What is the balance on this loan?

If we assume that Jim has the money, what interest rate must he earn on alternative investments in order not to accept the bank offer?

5. Sam wants to save money to meet two objectives. First, he would like to buy a fishing boat 5 years from today at an estimated cost of $15,000.

Second, he would like to retire 20 years from now and have a retirement

income of $50,000 per year for at least 20 years. Sam can afford to save only $10,000 per year for the first 10 years.

He expects to earn 8% per year on average from his savings over the next 40 years.

What must his minimum yearly savings be for the second 10 years to meet his objectives?

6. John and Daphne are saving for their daughter Ellen’s college education. Ellen just turned 10 at (t = 0), and she will be entering college 8 years from now (at t = 8). College tuition and expenses at State U. are currently $14,500 a year, but they are expected to increase at a rate of 3.5% a year.

Ellen should graduate in 4 years–if she takes longer or wants to go to graduate school, she will be on her own.

Tuition and other costs will be due at the beginning of each school year (at t = 8, 9, 10, and 11). So far, John and Daphne have accumulated $15,000 in their college savings account (at t = 0). Their long-run financial plan is to add an additional $5,000 in each of the next 4 years (at t = 1, 2, 3, and 4).

Then they plan to make 3 equal annual contributions in each of the following years, t = 5, 6, and 7. They expect their investment account to earn 9%.

How large must the annual payments at t = 5, 6, and 7 be to cover Ellen’s anticipated college costs?

Subject: Masters Finance

Answer preview for the paper on ‘Leslie Printing has net income of $26,310 for the year. At the beginning of the year, the firm had common stock of $55,000,’

APA 1229 words

Click the purchase button below to download full answer…….