Create a summary table/flow chart of the existing Anti-Money Laundering (AML) regime or, in other words, the variety of actors

Create a summary table/flow chart of the existing Anti-Money Laundering (AML) regime or, in other words, the variety of actors

Assignment 6

Purpose: Create a summary table/flow chart of the existing Anti-Money Laundering (AML) regime or, in other words, the variety of actors, agencies, and collection of standards, norms, and rules, which were developed to respond to money laundering. For this assignment you should refer to the following report:

World Bank (2006). Reference Guide to Anti-Money Laundering and Combating the Financing of Terrorism Second Edition and Supplement on Special Recommendation IX. Washington, DC: World Bank. http://siteresources.worldbank.org/EXTAML/Resources/396511-1146581427871/Reference_Guide_AMLCFT_2ndSupplement.pdf

You should create a flowchart/table based on the report.

Format: You are free to use any software. It can be Microsoft Word, Powerpoint, or other existing platforms. The final file, however, must be submitted in a .PDF format to avoid any distortions. You are also required to write 500 words summary of the Infographics/flow chart.

Please consider the following guidelines:

- For this assignment, you do not always have to write in full sentences and may use bullet points. You do, however, need to summarize the findings presented in your infographics.

- You are not going to be penalized for failing to include all existing organizations, tools, and practices. It is absolutely understandable that there are too many of them. Focus on the most important, widely recognized, and/or reputable elements of the AML regime.

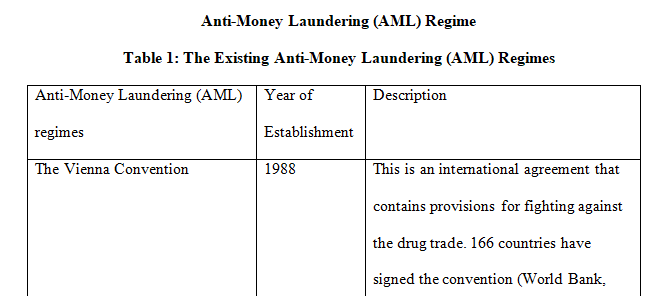

Assignment: Study the World Bank reference guide [ World Bank (2006). Reference Guide to Anti-Money Laundering and Combating the Financing of Terrorism Second Edition and Supplement on Special Recommendation IX. Washington, DC: World Bank. http://siteresources.worldbank.org/EXTAML/Resources/396511-1146581427871/Reference_Guide_AMLCFT_2ndSupplement.pdf (include any additional sources if needed) and create a summary table of the AML regime or, in other words, the variety of actors, agencies, and collection of standards, norms, and rules, which were developed to respond to money laundering. The summary table/flowchart must include different categories of AML actors, including treaty law (1988 Vienna Convention; 2003 Palermo Convention, etc.), intergovernmental organizations (UNODC, FATF, the Basel Committee, MONEYVAL, etc.), regional bodies and organizations, etc. It should also include information about the existing global standards (i.e., legal system requirements) and best preventive measures (e.g., custom due diligence, reporting, record keeping and sharing, etc.). It is not sufficient to just list entries. Each element of the AML regime should include a short summary that provides further information about the key mandate/focus of the entry and other relevant information (e.g., membership, headquarters, financing, etc.). In this assignment, you are asked to focus on the existing international and regional responses. It is thus not required that you include information about domestic responses, such as the US legislation, compliance requirements, and other domestic tools and mechanisms.

Assigned readings:

- Weld, J.B. (2011). Current International Money Laundering Trends and Anti-Money Laundering Co-Operation Measures

- Current International Money Laundering Trends and Anti-Money Laundering Co-Operation Measures – Alternative Formats

- . Resource Material Series No. 83. UNAFEI Fuchu, Japan.

- FATF (2014). Virtual Currencies: Key Definitions and Potential AML/CTF Risks

- Virtual Currencies: Key Definitions and Potential AML/CTF Risks – Alternative Formats

- . Paris: Financial Action Task Force.

- Gilmore, W. (2014). Chapter 20 “Money Laundering”

- Chapter 20 “Money Laundering” – Alternative Formats

- (pp. 331-346). In N. Boister and R.J. Currie (eds.), Routledge Handbook of Transnational Criminal Law. London: Routledge.

- Passas, N. (2005). Informal Value Transfer Systems, Terrorism and Money Laundering. Report to the National Institute of Justice.

Additional readings:

- Passas, N. (2005). Informal Value Transfer Systems, Terrorism and Money Laundering. Report to the National Institute of Justice.

- Informal Value Transfer Systems, Terrorism and Money Laundering. Report to the National Institute of Justice. – Alternative Formats

- Passas, N. (2016). Hearing on “Trading with the Enemy: Trade-Based Money Laundering is the Growth Industry in Terror Finance” Before the House Financial Services Committee Task Force to Investigate Terrorism Financing.

- Hearing on “Trading with the Enemy: Trade-Based Money Laundering is the Growth Industry in Terror Finance” Before the House Financial Services Committee Task Force to Investigate Terrorism Financing. – Alternative Formats

- Simser, J. (2013). Money laundering: Emerging Threats and Trends.

- Money laundering: Emerging Threats and Trends. – Alternative Formats

- Journal of Money Laundering Control, 16(1): 41-54.

- Hardouin, P. (2009). Banks Governance and Public-Private Partnership in Preventing and Confronting Organized Crime, Corruption and Terrorism Financing

- Banks Governance and Public-Private Partnership in Preventing and Confronting Organized Crime, Corruption and Terrorism Financing – Alternative Formats

- , Journal of Financial Crime, 16(3): 199-209.

Answer preview for the paper on ‘Create a summary table/flow chart of the existing Anti-Money Laundering (AML) regime or, in other words, the variety of actors’

APA 1530 words

Click the purchase button below to download full answer…….