Bond P is a premium bond with a coupon rate of 8.2%. Bond D is a discount bond with a coupon rate of 5.9%

Bond P is a premium bond with a coupon rate of 8.2%. Bond D is a discount bond with a coupon rate of 5.9%

PROBLEM SET TWO

Please answer all the questions as completely as possible.

Each question is worth 10 points.

Please download the problem set and upload your completed problem set as a word or pdf documents.

The problem set is due no later than midnight of 03/12/2023.

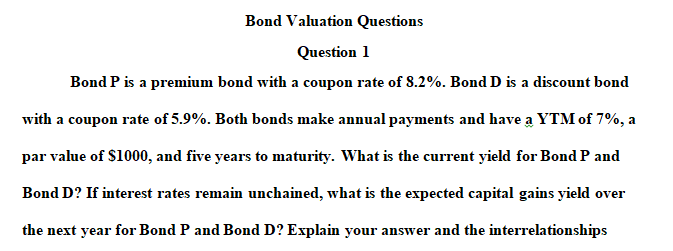

1. Bond P is a premium bond with a coupon rate of 8.2%. Bond D is a discount bond with a coupon rate of 5.9%. Both bonds make annual payments and have a YTM of 7%, a par value of $1000, and five years to maturity. What is the current yield for Bond P and Bond D? If interest rates remain unchained, what is the expected capital gains yield over the next year for Bond P and Bond D? Explain your answer and the interrelationships among the various types of yields.

2. Suppose you buy an annual coupon bond with a coupon rate of 6% for $915. The bond has 10 years to maturity and a par value of $1000. What rate of return do you expect to ern on your investment? Two years from now the YTM on your bond has declined by one percentage point, and you decide to sell. What is the holding period yield on your investment? Compare this yield to the YTM when you first bought the bond. Why are they different?

3. Kebt Corporation’s Class Semi bonds have a 12-year maturity and an 8.75% coupon paid semiannually (4.375% each 6 months), and those bonds sell at their $1,000 par value. The firm’s Class Ann bonds have the same risk, maturity, nominal interest rate, and par value, but these bonds pay interest annually. Neither bond is callable. At what price should the annual payment bond sell?

4. Consider four different stocks, all of which have a required return of 19% and a most recent dividend of $2.40 per share. Stocks W, X, and Y are expected to maintain a constant growth rates in dividends for the foreseeable future of 8%, 0%, and -5% per year respectively. Stock Z is a growth stock that will increase its dividend by 20% for the next two years and then maintain a constant 12% growth rate thereafter. What is the dividend yield for each of these four stocks? What is the expected capital gains yield. Discuss the relationship among the various returns that you find for each of these stocks.

5. Suppose a company currently pays an annual dividend of $2.80 on its common stock in a single annual installment, and management plans on raising this dividend by 6% per year indefinitely. If the required return on is 12%, what is the current share price? Now suppose the company actually pays its annual dividend in equal quarterly installments: thus, the company has just paid a dividend of $.70 per share, as it has for the previous three quarters. What is your value for the current share price now? (Hint: Find the equivalent annual end-of-year dividend for each year.). Do you think this model for stock valuation is appropriate?

6. DHF Company has a beta of 1.5 and is currently in equilibrium. The required rate of return on the stock is 12.00% versus a required return on an average stock of 10.00%. Now the required return on an average stock increases by 30.0% (not percentage points). Neither betas nor the risk-free rate change. What would DHF’s new required return be?

7. Huxley Building Supplies’ last free cash flow was $1.75 million. Its free cash flow growth rate is expected to be constant at 25% for 2 years, after which free cash flows are expected to grow at a rate of 6% forever.

Its weighted average cost of capital WACC is 12%. Huxley has $5 million in short-term investments and $7 million in debt and has 1 million shares outstanding.

What is the best estimate of the current intrinsic stock price?

Requirements: None

Masters Finance

please cite the book of Corporate Finance, 7th EditionBy: Ehrhardt, Michael C. / Brigham, Eugene F.ISBN: 978-1-337-90974-7 and once the discussion is completed I will send you three peer reviews to respond to thank you.

Answer preview for the paper on ‘Bond P is a premium bond with a coupon rate of 8.2%. Bond D is a discount bond with a coupon rate of 5.9%’

APA 1536 words

Click the purchase button below to download full answer…….